WA Claimant: Preparing & Serving the Payment Claim

A person who, under a construction contract, has carried out construction work and/or supplied related goods and services is entitled to receive a progress payment for work performed.

The claimant (the person claiming a progress payment) may serve a payment claim on and from the last day of the named month in which the construction work was first carried out (or related goods and services were first supplied) under the contract and on and from the last day of each subsequent named month.

However, if the construction contract makes provision for an earlier date in a named month (e.g. 25th of the month), than that will be the applicable date rather than the last day of the month.

If a construction contract has been terminated, a payment claim can be served on and from the date of termination.

Your Lockbox

Adjudicate Today knows that making payment claims which comply with the requirements of the Act can be challenging.

You need to indicate the amount owed, describe the items and quantities of the work or service provided and, if applicable, attach necessary documents e.g. completion certificates, dockets confirming the receipt of goods. There are rules about when payment claims can be made. If you make a claim about residential work, there are more rules. While we encourage you to read below, our online wizard is available to walk you through each step in making and serving a valid payment claim.

Our wizards are smart but to use them you need to establish a free and no obligation 'Lockbox'. The Lockbox is yours and can't be accessed by Adjudicate Today staff or anyone else without your express permission. Adjudicate Today does not charge for creating your Lockbox or using our wizards. Your Lockbox allows you to save and print the payment claim. If generating your payment claim via your Lockbox Wizard, a PDF document will be generated which contains a link to the files in your Lockbox for this particular payment claim. If service of the payment claim is agreed to between the parties by Lockbox or electronic link, then you may download and send this PDF document to the other party. If service of the payment claim is agreed to between the parties by email, then you must download all files in the link in this PDF and send those files as an attachment to the email. You must otherwise download all files, print them and provide them to the Respondent, preferably by courier. The Lockbox can remind you when payments are overdue. To use your Lockbox and access Adjudicate Today wizards click here, otherwise continue to read below for manual assistance in making a payment claim and/or clarification of any uncertainties in completing our online payment claim wizard. In all cases, the Claimant MUST make its own enquiries to satisfy itself of the most suitable method of service.

It is important to provide the information requested by our payment wizard. Courts have held that works must be sufficiently identified in the payment claim and 'it is not up to the recipient to sort through previous payment claims to ascertain work to which a new payment claim related'.

What is a payment claim?

A payment claim is a written progress claim (invoice) which allows recovery of money owed using the Act.

It must:

- be served by or on behalf of a claimant; and

- contain the words: “This is a payment claim made under the Building and Construction Industry (Security of Payment) Act 2021 (WA)” or words to that effect; and

- identify the respondent and the construction work performed or related goods and services; and

- indicate the amount claimed. A claim for $10,000 + GST should be described as $11,000 including GST;

- describe the items and quantities of work done or related goods and services provided; and

- relate to work performed on or prior to the last day of the named month (or earlier day if provided by contract). If the payment claim is served early, it can't be used to support an application for adjudication.

A progress claim may include:

- The final payment for construction work carried out or the supply of the goods/services under the construction contract; or

- A single or one-off payment for carrying out construction work or the supply of goods/services under the construction contract; or

- A payment based on an event or date (“milestone payment”).

This does not prevent the claimant making one payment claim for a progress payment in any particular month for construction work carried out or for related goods and services supplied in that month.

Qualifications:

- Only one progress claim can be made for each month. Multiple progress claims can't be made in relation to the same month. However a progress claim which was previously submitted and not paid in whole or part, can be incorporated as part of a new progress claim in respect of a later month.

- Unless the construction contract provides for a longer period, a progress claim must be made within 6 months after the construction work to which the claim relates was last carried out or the related goods and services to which the claim relates was last supplied. Construction contracts may provide for longer periods e.g. a contract which provides for a 12 months defects liability period. Here a final payment claim can be made within 28 days after the end of the defects liability period. While a contract can extend the period of 6 months, it can't reduce it.

- Unless additional work has been undertaken, progress claims (or parts of progress claims), which are the subject of an earlier adjudication determination can't be resubmitted in a subsequent progress claim. That is, exactly the same work can’t be submitted to a second adjudication if the claimant is not satisfied with the result of the first adjudication. Where there is an overlap of work (some previously adjudicated and some new), the second adjudicator must give the previously adjudicated work the same value as the first adjudicator.

- A payment claim served on an individual residential homeowner must relate to work where the total value of the contract, including variations, is over $500,000. When such payment claim is served on an individual homeowner, it must be accompanied by a supporting statement. The supporting statement, required by the WA Government, is available here.

- A payment claim is not valid if you are a company in liquidation (i.e. being wound up).

Identify the Respondent

Ensure the payment claim is addressed to the legal entity that the claimant contracted with (the respondent). It is no use seeking an adjudication determination against a respondent if the name and/or ACN/ABN is incorrect. Courts won't enforce determinations unless the name and ACN/ABN of the respondent match. Here are three examples (with names changed) of problems encountered.

- A contract is entered into with "Respondent (WA) Pty Ltd" but payments are received from "Respondent Pty Ltd" An adjudication application failed when the claimant applied for a determination against "Respondent Pty Ltd" which was not the company and ACN/ABN as identified in contract.

- A claimant was engaged under contract by a consortium but all dealings and payments were with one individual company member of the consortium. As the contract was with the consortium, an application against the individual member of the group couldn't succeed.

- A claimant contracted with Fred Smith (legal entity) trading as ABC Building (trading name) but the payment claim was issued to ABC Building. An adjudication determination can't be enforced against a trading name. The payment claim should have been issued to Fred Smith.

Am I entitled to make a payment claim under the Act?

Those who can make a payment claim under the Act include:

- contractors against clients (e.g. principals, developers, owner-builders, government);

- subcontractors against contractors;

- suppliers of building components against purchasers;

- architects, engineers, and others (e.g. consultants) providing advice against clients;

- plant and equipment hirers against clients.

Construction work and services can be claimed under the Act even if the contract is not written and/or does not provide for progress payments. e.g. a contract provision providing for a single payment to be made when work is completed is unenforceable. Claimants are entitled to be paid every month.

What work is covered?

Construction work and the supply of related goods and services includes:

- building work;

- civil engineering;

- demolition;

- electrical;

- hire of plant or equipment;

- landscaping;

- maintenance;

- professional services such as architectural design, surveying and soil testing;

- supply of building materials.

What can I claim for?

A claimant can make a payment claim on the respondent for:

- construction work done;

- construction materials or plant provided;

- consulting services provided;

- interest on overdue progress payments;

- losses and additional expenses due to work being deleted from contract while work is suspended under the protection of the Act;

- cash security & retention monies.

What information should be included with a payment claim?

A payment claim should include all information necessary for a respondent to both identify the work and how the sum claimed is calculated. During adjudication, some respondents have successfully argued that they could not approve payment because the work claimed was so vague as to make it impossible to be confidently valued.

Where available, payment claims should include attachments such as:

- statements detailing the extent of the work completed;

- completion certificates;

- delivery dockets;

- dated photographs of the work;

- other contract documentation as may be required by the contract.

Download template of a Payment Claim which is published by the WA Building Commission

How is a Payment Claim served?

Unless otherwise agreed by the parties, the payment claim must be provided to the respondent during normal business hours at the respondent's ordinary place of business or in accordance with the WA Electronic Transactions Act 2011 section 14. Your lockbox may be used to electronically serve documents.

In our experience, below is the safest ranking to ensure service:

- Use your lockbox to send the payment claim to the respondent if there is an agreement between the parties for service via lockbox or link

- Courier - signature required

- Mail - Express Post: keep express post tracking number for delivery verification

- Platinum Post - Signature required

- Ordinary Post - Make a statement verifying the address, date of postage and other relevant details

- Email (only to an email address which is specified by the person for the services of documents of that kind - generally the respondent). In email options, we advise tick both "request a delivery receipt" and "request a read receipt". All documents must be downloaded and attached to the email as an attachment, unless there is an agreement to service by a link.

- In person - Ensure a receipt is obtained or

- A different method only where such method is provided under the relevant construction contract. Please note that service by fax is only valid if provided by the contract. If service by fax is permitted, print and keep full page fax journal report as evidence of transmittal.

Tips:

- Claimants are strongly advised to keep a record of the time, date and manner of service on the respondent. The time for the respondent to provide the payment schedule (response) runs from the date of receipt of the payment claim. A respondent may deny receipt of the payment claim in which case the claimant must be able to evidence the date of service.

- When items are sent by ordinary post, allow sufficient time for them to be received. Generally, items sent by ordinary post are deemed to be received on the fourth working day after posting. We recommend against post as respondents have denied receipt.

- Should fax be permitted by contract as a form of service, ensure you retain the full page fax receipt and refrain from sending colour photographs, and plans as they are generally unreadable. Lengthy faxes have been known to lose pages in transmission.

When should I receive payment - Calculating the due date for payment?

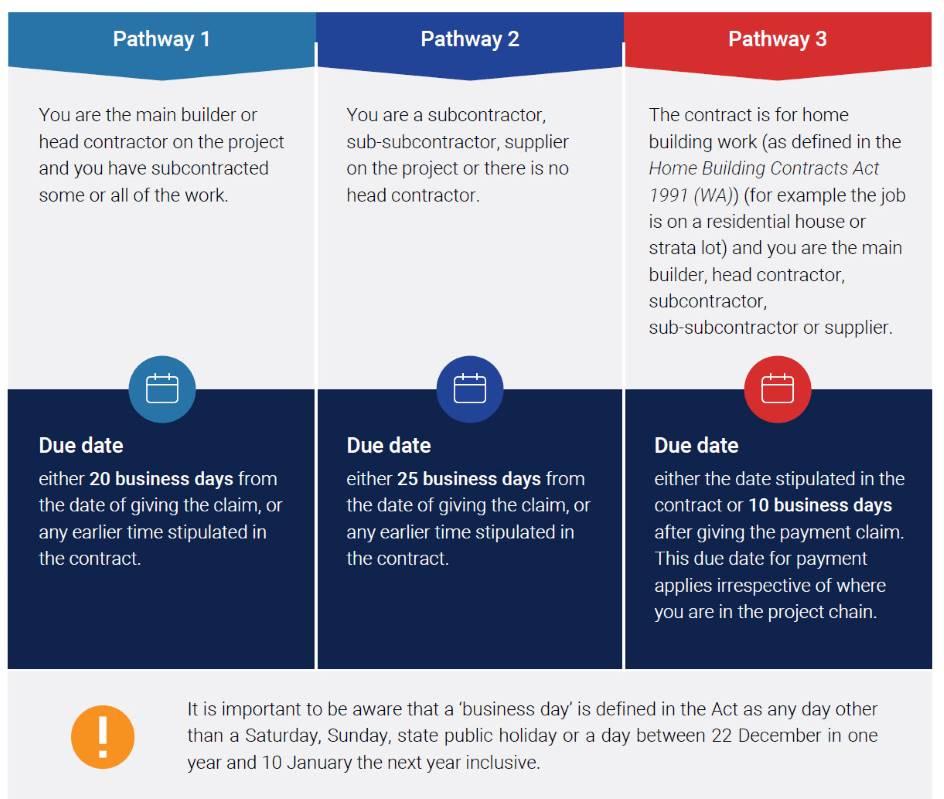

A claimant is entitled to be paid a valid progress payment claim by the due date for payment.

Once a payment claim has been given under the Act, the due date for payment depends upon the claimant's position in the contractual chain.

Can the Act be used to secure payment from individual residential homeowners?

Yes, but only in relation to a contracts with an individual (natural person) residential homeowner where the total value of the contract, including variations, is more than $500,000 (including GST). When such payment claim is served on an individual (natural person) residential homeowner (the respondent), it must be accompanied by a supporting statement. The supporting statement, required by the WA Government, is available here. If the supporting statement is not included, it is not a valid payment claim.

However:

- If the contract is for work other than on the respondent's immediate residence (or intended residence), then that work is subject to the Act. e.g. work involving a residential investment property. Note: The respondent's immediate residence includes 1 or 2 dwellings (detached or attached) on the same lot of land.

- If the homeowner did not contract directly with the claimant, then that work is subject to the Act. Examples of work on residential properties that are subject to the Act include contractor contracts with landlords, strata title bodies corporate, developers, builders, subcontractors and sub-subcontractors, consultants and suppliers.

What else is excluded by the Act?

- A construction contract that deals with construction work or related goods and services physically carried on outside WA. In this situation, an adjudication application should be made under the Security of Payment Act relevant to the State in which the work was performed.

- The particular work under the contract requires you hold a registration under the Building Services (Registration) Act 2011 (WA) and you do not hold the requisite registration for that work or supply.

- A construction contract that regulates an employer/employee relationship.

- A construction contract that forms part of a loan agreement, a contract of guarantee or a contract of insurance under which a recognised financial institution undertakes to lend or repay an amount lent; guarantee payment of an amount owing or repayment of an amount lent; or provide an indemnity relating to construction work carried out or related goods and services supplied.

- Contracts where the amount payable is calculated other than by reference to the value of the work performed.

- A corporation in liquidation cannot serve a payment claim or take action to enforce a payment claim (including by making an application for adjudication of the claim) or an adjudication determination. If the corporation in liquidation has made an adjudication application that is not finally determined immediately before the day on which it commenced to be in liquidation, the application is taken to have been withdrawn from that day.

How long do I have to wait for a payment schedule in response?

The next step in our flowchart provides crucial information for both claimants and respondents. Depending on whether a respondent does or does not provide a payment schedule to the claimant within 15 business days' results in different time frames and procedures.

The respondent who fails to provide a payment schedule within 15 business days must be given a second opportunity to provide one. If it fails a second time, the Act effectively punishes the respondent by denying it the right to participate in the adjudication process.

Please move to the next step on the flowchart being "Respondent has 15 business days after receipt of the Payment Claim (or shorter period if provided by construction contract) to prepare and serve a Payment Schedule".