WA Respondent: Preparing & Serving the Payment Schedule

A payment schedule (response to a payment claim) need only be prepared if the respondent does not intend to pay the full amount of a payment claim by the due date for payment.

IGNORING A PAYMENT CLAIM WITHOUT INTENTION TO PAY IN FULL BY THE DUE DATE FOR PAYMENT MAY HAVE SERIOUS FINANCIAL CONSEQUENCES.

Who is a Respondent?

A respondent is a person who has received a payment claim under the Act.

What is a payment schedule?

A payment schedule is the notice in writing which must be served on the claimant if the respondent does not intend to pay the full amount of a payment claim by the due date for payment. This is regardless of the respondent believing that the claimant is or is not entitled to make the claim or if the respondent denies being party to the contract. Assuming a payment claim is not valid, and therefore can be ignored, is risky. Click here for details about a payment claim.

The payment schedule is due within 15 business days after receipt of the payment claim, or a shorter period if provided by the contract. A contract provision seeking to extend the period for the provision of a payment schedule beyond 15 business days is void.

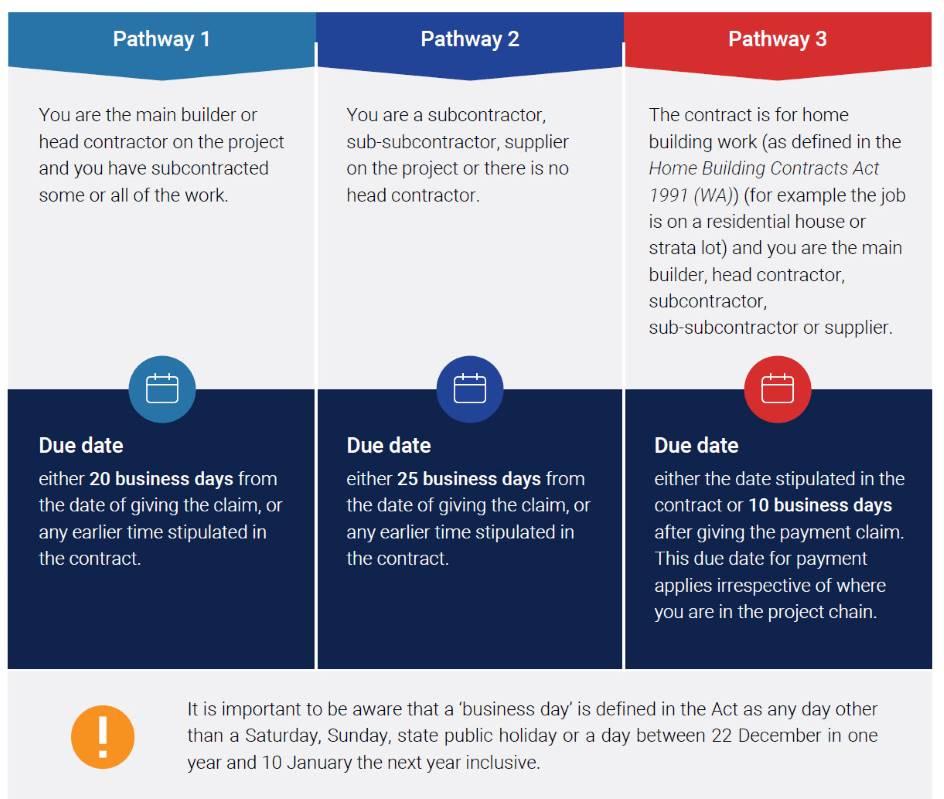

What is the due date for payment - How is it calculated?

A claimant is entitled to be paid a valid progress payment claim by the due date for payment.

Once a payment claim has been given under the Act, the due date for payment depends upon the claimant's position in the contractual chain.

Your Lockbox

Adjudicate Today knows that responding to payment claims can be challenging. You need to provide a written response within 15 business days (the payment schedule) or lesser period if provided by contract, indicate the amount (if any) you propose to pay and indicate any reasons for withholding payment. If applicable, you may attach documents supporting your reasons for withholding any payments. While we encourage you to read below, our online wizard is available to walk you through each step in making and serving a valid payment schedule.

Our wizards are smart but to use them you need to establish a free and no obligation 'Lockbox'. The Lockbox is yours and can't be accessed by Adjudicate Today staff or anyone else without your express permission. Adjudicate Today does not charge for creating your Lockbox or using our wizards. Your Lockbox allows you to save and print the payment schedule. If generating your payment schedule via your Lockbox Wizard, a PDF document will be generated which contains a link to the files in your Lockbox for this particular payment schedule. If service of the payment schedule is agreed to between the parties by Lockbox or electronic link, then you may download and send this PDF document to the other party. If service of the payment schedule is agreed to between the parties by email, then you must download all files in the link in this PDF and send those files as an attachment to the email. You must otherwise download all files, print them and provide them to the Claimant, preferably by courier. The Lockbox can remind you when payments are overdue. To use your Lockbox and access Adjudicate Today wizards click here, otherwise continue to read below for manual assistance in making a payment schedule and/or clarification of any uncertainties in completing our online payment schedule wizard. In all cases, the Respondent MUST make its own enquiries to satisfy itself of the most suitable method of service.

Adjudicate Today and its staff can not access a payment schedule saved to your Lockbox unless the payment schedule is submitted with an adjudication application or adjudication response to the Adjudicate Today Lockbox.

A payment schedule must:

- Be in writing and addressed to the claimant;

- Identify the payment claim to which it relates;

- indicate the scheduled amount of payment that it is proposed be paid (it may be "nil");

- If the amount that the respondent proposes to pay is less than the amount claimed in the payment claim, the respondent should set out:

- The amount (if any) that the respondent agrees to pay - the "scheduled amount";

- The amount that the respondent does not agree to pay;

- Reasons and any supporting attachment(s) as to why the respondent intends withholding any amount, including how the valuation of the withheld amount is calculated.

- statements detailing the extent of the work completed;

- completion certificates;

- delivery dockets;

- dated photographs;

- other documentation as may be required by the contract.

Include all reasons for withholding payment

Make sure all reasons for withholding any payment are provided to the claimant. The Act does not permit you to raise new or additional reasons for withholding payment if the claimant applies for adjudication. Further the adjudicator is not permitted to take into consideration any new or additional reasons when making a determination.

Download template of a Payment Schedule which is published by the WA Building Commission

How is a Payment Schedule served?

Unless otherwise agreed by the parties, the payment schedule must be provided to the claimant during normal business hours at the claimant's ordinary place of business or in accordance with the WA Electronic Transactions Act 2011 section 14. Your lockbox may be used by owners for this purpose. In our experience, below is the safest ranking to ensure service:

- Use your lockbox to send the payment schedule to the claimant if there is an agreement between the parties for service via lockbox or link

- Courier - signature required

- Mail - Express Post: keep express post tracking number for delivery verification

- Platinum Post - Signature required

- Ordinary Post - Make a statement verifying the address, date of postage and other relevant details

- Email (only to an email address which is specified by the person for the services of documents of that kind - generally the respondent). In email options, we advise tick both "request a delivery receipt" and "request a read receipt". All documents must be downloaded and attached to the email as an attachment, unless there is an agreement to service by a link.

- In person - Ensure a receipt is obtained or

- A different method only where such method is provided under the relevant construction contract. Please note that service by fax is only valid if provided by the contract. If service by fax is permitted, print and keep full page fax journal report as evidence of transmittal.

Tips

- Respondents are strongly advised to keep a record of the time, date and manner of service on the claimant. A claimant may deny receiving a payment schedule in which case the respondent must be able to evidence the date of service.

- When items are sent by ordinary post, allow sufficient time for them to be received. Generally, items sent by ordinary post are deemed to be received on the fourth working day after posting. We recommend against post as claimants have denied receipt.

- Should fax be permitted by contract as a form of service, ensure you retain the full page fax receipt and refrain from sending colour photographs, and plans as they are generally rendered unreadable. Lengthy faxes have been known to lose pages in transmission.

What contract provisions are void by the Act?

A common reason for respondents not agreeing to a payment claim is that they have not been paid by the principal. Effectively the respondent is imposing on the claimant an extension of payment terms. This defence of "pay when paid" or "pay if paid" is expressly barred by the Act, even if such right is included in the contract. The policy behind the Act is that a respondent should not cause a claimant financial detriment because of their problems. In any case, respondents can seek a remedy under the Act by serving a payment claim on the principal and applying for adjudication.

Other void contract provisions include:

- Any provisions that are inconsistent with the Act;

- Clauses that attempt to "contract out" of the Act;

- Unjust penalty provisions;

- Clauses aimed to deter a person from taking action under the Act; and

- Any provision which limits interest on late progress payments at a rate less than the rate of interest on judgments of the Supreme Court.

What happens if the payment schedule is not served within time?

A payment schedule should be served on the claimant within 15 business days of the payment claim or shorter period if provided by the construction contract. A respondent who fails to comply must be given a second opportunity to provide a payment schedule. If the respondent ignores the second opportunity, the Act denies the respondent the right to participate in the adjudication process. The respondent is being punished for failure to comply with the Act.

The requirement on the claimant to provide a second opportunity to the respondent to provide a payment schedule results in different time frames and procedures.

- Procedure 1 - Respondent serves a payment schedule within 15 business days after receipt of the claimant's payment claim

The respondent provides the claimant with a payment schedule within 15 business days of receipt of the payment claim. (Note: Service by the respondent of a payment schedule after 15 business days renders the payment schedule invalid - go to procedure 2).

The claimant seeks adjudication because either there is a dispute over the respondent's reasons for withholding some or all of the claimed amount; or the claimant has accepted the payment schedule but the respondent fails to pay the scheduled amount by the due date for payment.

The blue shaded section of the flowchart describes how to proceed in these circumstances.

- Procedure 2 - Respondent does NOT serve a valid payment schedule within 15 business days (or shorter period if provided by the construction contract) after receipt of the claimant's payment claim

When a respondent fails to serve a payment schedule within 15 business days after receipt of the claimant's payment claim, the Act requires the claimant to send the respondent a notice under section 28(2). The notice must be served within 20 business days of the due date for payment. The effect of this notice is to provide the respondent with a second opportunity to serve the claimant with a payment schedule; however within the shorter period of 5 business days.

Once the claimant serves the section 28(2) notice, there are two mutually exclusive possibilities.

Either the respondent:

- serves; or

- does not serve

a valid payment schedule within 5 business days after receipt of the section 28(2) notice.

The respondent who serves a payment schedule within 5 business days suffers no disadvantage. The respondent who fails to serve a payment schedule within time is denied the right to participate in the adjudication process.

The pink shaded section of the flowchart describes both the procedures and time frames of serving the section 28(2) notice and how to proceed to adjudication if the respondent again fails to issue a payment schedule or, if the respondent does serve and the claimant does not agree with the payment schedule or, the respondent fails to pay a scheduled amount.

Parties must comply with the statutory procedures and time frames of the Act. Failure to comply may have serious consequences. Some examples of common errors which can't be corrected by either Adjudicate Today or the adjudicator:

- The respondent provides the payment schedule after 15 business days (e.g. business day 16). As it is invalid, the claimant must serve the section 28(2) notice and the respondent must provide (again) the payment schedule (within 5 business days of receipt of the section 28(2) notice).

- The claimant prepares and serves the adjudication application after 20 business days (e.g. business day 21) of receipt of a payment schedule. As the statutory time has passed, the payment claim has expired and the adjudicator must determine that the application is invalid.

- The claimant prepares and serves an adjudication application on Adjudicate Today and/or the respondent prior to the expiry of the 5 business days permitted to a respondent under section 28(2). The application is invalid as it has been served early. The claimant should have waited the elapse of the fifth business day. The application may be served again after the fifth business day from the respondent's receipt of the section 28(2) notice and before the twentieth business day expires.

The lesson from each of these examples is to count business days carefully, remembering that the first business day is the first day after service (excluding Saturday, Sunday, public holidays and all days between 22 December and 10 January the next year inclusive) i.e. the first business day of service is day 0.

Based on your actual circumstances, our professional staff are available to help with each statutory step.

Please move to the next step on the WA flowchart by selecting either "Respondent serves a Payment Schedule on Claimant within time" or "Respondent FAILS to serve a Payment Schedule on Claimant within time", whichever applicable".